11/ PROPORTIONALLY TO THE TOTAL PAID WORKFORCE, generate the economic capital (EC) expected from two regulatory constraints to which the company is subject

Human capital Added value:

Since 2010, all listed companies have been required to report on the management of their “human capital”.

• This requirement has been extended to SMEs and local authorities since January 2019 given the context of 100% LCR in which all companies operate for WCR and investment financing.

Extra-financial performance statement:

Since 2014, all companies are obliged, when they reach a certain level of turnover, to include in their governance report a NON-FINANCIAL PERFRORMANCE STATEMENT.

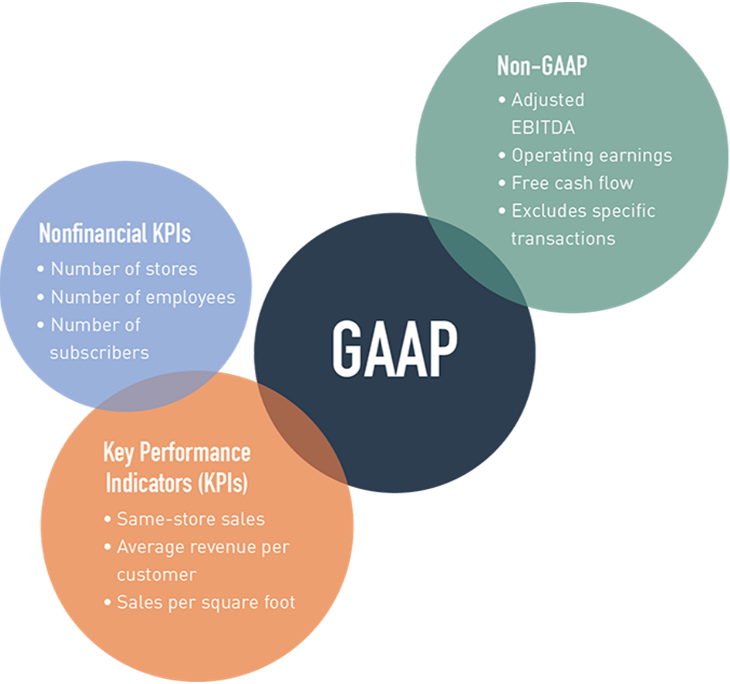

• HCM accounting is the way to avoid the danger of relying on non-GAAP earnings as an alternative to income statements. HCM accounting provides non-GAAP non-financial performance reporting that should not be confused with APMs. This is a debate within financial accounting.

“Non-GAAP information contained in a company's communications with investors often provides information about how management perceives its performance” (Marc Siegel, FASB member, 2014 Q4, For the Investor: The Use of Non-GAAP Metrics):

• Due to the lack of HCM tools, most of the subject companies limited themselves to the CSR aspect without providing the required economic capital management accounts.

The fundamental requirement is that the non-financial performance disclosed must be linked to the economic model of the company (its business plan) and to the financial information relating to the achievement (the profit and loss accounts).

• The declaration of extra-financial performance therefore falls within the domain of management accounting (We also say cost accounting, corporate accounting or Enterprise Risk Management).

Hence the methodological focus on human capital:

• Human resources have a preponderant effect on operational risks because they are dysfunctions resulting from inadequacies or failures resulting from internal procedures, people and systems. Consequently, operational risk losses are the same for all banks and all their customers, regardless of their sector of activity (financial and non-financial companies, local authorities and public services in the broad sense).

We have learned since Basel II that Operational risk impacts all other risks:

• Credit counterparty risk or signature risk (Client risk and Country risk);

• Transformation risk (large gap between different maturities of receivables and debts) and illiquidity;

• Organizational risk (Workforce, Equipment and ENVIRONMENT);

• Market risk (errors that can be made by processing payments or settling transactions).

Losses linked to operational risks are overloads of management accounts and non-income (unrealized income). Operational risk losses have a clear impact on product cost, capital, competitiveness, income statement and risk counterparty.

• Management accounts are therefore the point from which a company demonstrates through extra-financial reporting how its management accounting system based on the total paid workforce takes over from the published financial information to provide the accounts of the added value of human capital in human capital gains improving its future performance.

The extra-financial declaration misses its target (its value in use), and in this case it becomes cost (resources allocated to the CSR audit) without counterpart in economic benefit, if it does not provide the accounts of the added value of the human capital of the company. These are additional gains improving and justifying the evolution of its future performance, in particular the economic capital (CE) which leads to the evolution of its turnover and ROI on the basis of a multi-year plan (3 years) mitigating operational risk losses considering the risk appetite threshold to which its field of activity is subject.