12/Mitigating investor risk

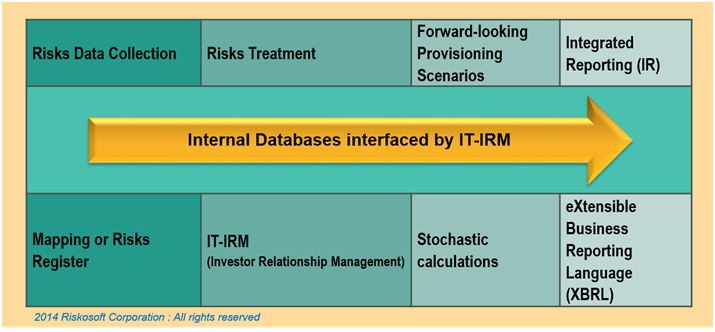

To do this, it is necessary to fill the gaps in the interaction of risk management machines to reduce the margin of error of the forward looking data provided to the investor.

This problem has been known since 2003, just a year after the publication of the SOX Act. This is the Investor Relationship Management (IRM) aspect of Business Intelligence (BI) decision-making to provide the investor with data to measure the effectiveness of business processes or ERM of a Counterparty Credit Risk (CCR). This issue was the subject of an open debate in the United States by SIEBEL during the launching of Customer Risk Management (CRM):

• “If you have a big business process, but no ERM software of support, you are condemned to fail; if you have good ERM software but bad business processes, you are also condemned to fail ”said Steve Apfelberg, Sales Manager of SIEBEL (See Garry Kranz, Editor at SearchCRM.com, USA, March 25, 2004)

The promoters of mathematical solutions had estimated in 2003 that it was up to the company to solve the problem of processing operational risk data since a decision-making system was only intended to extract the data in order to disseminate them in the usual way. "A business intelligence platform is the key element for the analysis, simulation and optimization of business performance"(SAS Academic / The power to know).

It took the subprime crisis and the LCR requirement to understand the importance of SIEBEL's warning:

• The mathematical efficiency depends on the quality of the data that feeds the computing tools.

Until now, in order to calculate expected cash flows on a growth plan, all cash flow realization assumptions were considered. For each of the assumptions, the actuary associated a probability of realization; the expected value was a mathematical probability of the discounted cash flows.

• Because the company lacks a management accounting system, the mathematical tool filled this gap by collecting data on the web. The more the data processed is not that of the company in question, the greater the margin of error in the calculations. They only give the investor a particularly random overview of the prospects for growth and performance.

On December 7, 2017, the Group of Central Bank Governors and Supervisors of Banking Supervision (GHOS), which oversees the Basel Committee, approved the Basel III regulatory reforms underway after the financial crisis. This is the finalization of Basel III which the financial industry calls Basel IV. The BCBS proposes to rationalize the operational risk framework, both internal model approaches and existing standard approaches. These are replaced by a single standard risk sensitivity approach, applicable to all banks. The new standard operational risk approach determines a bank's capital requirements for operational risk based on two elements:

• A measure of bank income and

• A measure of its historical losses.

As a result, operational risk will increase with the bank’s income and those who have historically suffered larger losses due to operational risk are considered more likely to experience losses from operational risk in the future. This decision comes from the observation of one of the main causes of the subprime crisis:

• "Many banks lacked the ability to aggregate risk exposures and identify concentrations quickly and accurately at the bank group level, across business lines or between legal entities. Some banks were unable to manage risk properly because of weak risk data aggregation capabilities and risk reporting practices. These weaknesses had severe consequences for banks and for the stability of the financial system as a whole (The Financial Stability Board, Overview of Progress in the Implementation of the G20 Recommendations for Strengthening Financial Stability, November 14, 2014).

Operational risk losses are only inevitable when the entity does not have the capacity to mobilize and motivate the total paid workforce to mitigate them considering the risk appetite threshold.

• The simulator, vector 1 of HCM Accounting Technology (Riskosoft IT-IRM) to which the CEO and the Investor have free access was modeled to provide scenarios proving that the employer, instead of suffering operational risk losses, has set up interaction processes cross-cutting financial performance that anticipate its operational risk losses and provide evidence of economic capital accounts that avoid liquidity risk and bankruptcy risk.

The non-random risk aggregation model is a management accounting based on HR assets given the preponderant effect of the total paid workforce (human capital) on operational risk and the impact of operational risk losses on other risks.

• It is expressed by the UL + EL Absolute VaR equation to take into account both the historical income and losses of the last five years while the mathematical approach is only based on the unexpected losses (UL) of the typology of incidents or malfunctions of the Basel Committee (BCBS, June 30, 2006).

The reporting of human capital value added accounts (HCAV) or the simulation on Riskosoft IT-IRM vector 1 from historical data from the published income statements (Losses and Profits) is the appropriate accounting method to measure capacity of a company to anticipate, prevent and mitigate investor risk:

• Economic Capital is the amount of capital the firm should have to support any risks it takes on.